| The Audit Division | |

|

The Audit Division is responsible for independent reviews of Department of Justice organizations, programs, functions, computer technology and security systems, and financial statement audits. |

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 20 |

| The Audit Division | |

|

The Audit Division is responsible for independent reviews of Department of Justice organizations, programs, functions, computer technology and security systems, and financial statement audits. |

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 21 |

Audit Division

The Audit Division (Audit) reviews Department organizations, programs, functions, computer technology and security systems, and financial statements. Audit also conducts or oversees external audits of expenditures made under Department contracts, grants, and other agreements. Audits are conducted in accordance with the Comptroller General's Government Auditing Standards and related professional auditing standards. Audit produces a wide variety of audit products designed to provide timely notification to Department management of issues needing attention. It also assists the Investigations Division in complex fraud cases.

Audit works closely with Department management to develop recommendations for corrective actions that will resolve identified weaknesses. By doing so, Audit remains responsive to its customers and promotes more efficient and effective Department operations. During the course of regularly scheduled work, Audit also lends fiscal and programmatic expertise to Department components.

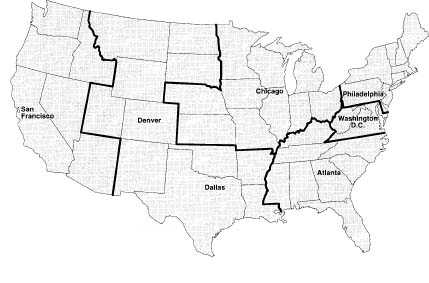

Audit has seven field offices across the country—in Atlanta, Chicago, Dallas, Denver, Philadelphia, San Francisco, and Washington, D.C. Audit's Financial Statement Audit Office and Computer Security and Information Technology Audit Office also are located in Washington, D.C. Audit Headquarters consists of the immediate office of the Assistant Inspector General for Audit, the Office of Operations, the Office of Policy and Planning, and an Advanced Audit Techniques Group. Auditors and analysts have formal education in fields such as accounting, program management, public administration, computer science, information systems, and statistics.

The field offices' geographic coverage is indicated on the map below. The San Francisco office also covers Alaska and Hawaii, and the Atlanta office also covers Puerto Rico and the U.S. Virgin Islands.

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 22 |

Overview and Highlights

During this reporting period, Audit issued 300 audit reports containing more than

$10.5 million in questioned costs and $504 million in funds to better use and

made 401 recommendations for management improvement. Specifically, we issued

18 internal reports of programs funded at more than $6.3 billion;

53 external reports of contracts, grants, and other agreements funded at more than

$58 million; 141 audits of bankruptcy trustees with responsibility for funds of

more than $216 million; and 88 Single Audit Act audits. Audit issued one

Management Information Memorandum, one Investigative Assistance Memorandum, three

Notifications of Irregularity, and eight Management Letter Transmittals.

Significant Audit Products

Summary of Police Hiring and Redeployment Grants Audits

The Violent Crime Control and Law Enforcement Act of 1994 (Crime Act) authorized the Attorney General to implement, over six years, an $8.8 billion grant program for state and local law enforcement agencies to hire or redeploy 100,000 additional officers to perform community policing. Our summary report consolidates the results of 149 audits performed from October 1996 through September 1998 of grantees receiving funds totaling $511 million.

Although our universe of grantees was not selected randomly and, therefore, our results may not be representative of all grantees, the frequency and magnitude of issues identified in our grant audits indicate that significant numbers of jurisdictions audited are: (1) overestimating salaries and benefits or including unallowable costs in reimbursement requests, (2) using federal funds to supplant local funds, (3) not making a good-faith effort to fill locally-funded sworn officer positions, (4) not submitting or submitting late status reports to the Office of Community Oriented Policing Services (COPS) and the Office of Justice Programs (OJP), and (5) not establishing systems to track the redeployment of officers into community policing. We also concluded that some jurisdictions may have difficulty retaining COPS-funded officer positions with local funds at the conclusion of the grants.

Management and Administration of the COPS Grants Program

This program audit reviewed COPS' and OJP's administration of the $8.8 billion community policing grant program. We evaluated (1) COPS' ability to meet the President's goal to put 100,000 additional police officers on the street by FY 2000, (2) COPS' and OJP's monitoring of grantees, and (3) the quality of guidance provided to grantees to assist them in implementing essential grant requirements.

We found that the COPS grants will not result in 100,000 additional officers on the streets by the end of FY 2000 because:

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 23 |

Significant Audit Products

We also determined that many grantees did not submit the required program monitoring and financial reports and that COPS' on-site monitoring reviews did not consistently cover all grant conditions. Moreover, COPS and OJP did not adequately follow up on deficiencies found in on-site reviews to ensure that the deficiencies were corrected.

COPS Issues in Dispute - The Audit Resolution Process

Almost every COPS grant audit report summarized in our April 1999 Summary of Police Hiring and Redeployment Grant Audits was appealed by COPS. Although COPS previously agreed with nearly all of our findings after its initial review of our grant reports, COPS now disputes virtually all audit findings in the areas of supplanting, retention, community policing, and redeployment. COPS appealed these findings to the Audit Resolution Committee (ARC), which is chaired by the Deputy Attorney General.

In June 1999, at the request of the Deputy Attorney General, the OIG agreed to select a sample of 40 findings (10 from each of the four categories noted above) for ARC's use in resolving the dispute. In August 1999, the Department hired a mediator/fact finder to resolve the disagreements between the OIG and COPS arising from this sample. Failing mediation, the mediator has been commissioned to submit recommended findings and proposed decisions to the Deputy Attorney General. As formulated, the inquiry addresses whether, at the time of the audit, the grantee was in compliance¾irrespective of whether the grantee provided such information to the OIG auditors. The process is ongoing, with the mediator's report due to the Deputy Attorney General in November 1999.

The Department's Counterterrorism Fund

In July 1995, in the wake of the Oklahoma City bombing, Congress created the Department of Justice Counterterrorism Fund (the Fund), under the administration of JMD, to assist Department components in responding to threats of terrorism. For FYs 1995 through 1998, Congress appropriated over $133 million to the Fund, of which about $106 million has been obligated to Department components for reimbursement of certain counterterrorism expenses.

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 24 |

Significant Audit Products

Although JMD maintains strong controls over the initial approval of planned expenditures,

our audit of the Fund revealed that JMD needs to take a more proactive approach to its

administrative duties and the actual expenditure of funds. Our review of transactions

totaling almost $26 million revealed over $4 million (16 percent) in

dollar-related deficiencies including $1.1 million in funds disseminated through the

FBI to state, local, and non-Department federal agencies that were either improperly used

or could be better used elsewhere and a total of $2.9 million that Department

components improperly used or could not support.

The need for stronger management controls is especially important in light of congressional action that has greatly increased the Fund balance. Approximately $145 million has been allocated to the Fund for FY 1999, a significant increase over past appropriations.

Y2K Efforts at DEA

Department components are responsible for identifying and correcting Y2K problems within their mission-critical computer systems. We initiated this review to determine the effectiveness of DEA initiatives to address the Y2K computer problem. At the time of our review, we had concerns regarding the thoroughness of the Independent Verification & Validation review process because of inadequate or missing evidence to support that DEA's mission-critical systems would be operable on January 1, 2000. We examined eight of DEA's mission-critical systems and found issues with six. At the time of our review, we were concerned that the 28 systems we did not review may have issues similar to those discussed in our report. However, subsequent to our review, DEA provided documentation that mitigated our concerns about these 28 systems as well as those we examined.

Follow-up Review of INS' Management of Automation Programs

We performed a follow-up audit of INS' management of its $2.8 billion automation programs. In our March 1998 audit, we reported that INS had not adequately managed its automation programs despite the fact that it already spent almost $500 million on these programs.

We found that INS still does not adequately manage its automation programs despite the fact that it now has spent over $800 million on these programs. As a result, (1) estimated completion dates for some projects have been delayed without explanations for the delays, (2) costs continue to spiral upward without justification for how the funds are spent, and (3) projects are nearing completion without assurance that they will meet performance and functional requirements. We recommended a series of improvements to INS' management of the automation initiatives. INS concurred with each of the recommendations and prepared an implementation plan to correct the deficiencies.

Department Financial Statement Audits

The Chief Financial Officers Act of 1990 and the Government Management Reform Act of 1994 require financial statement audits of the Department. Audit oversees and issues the reports based on the work performed by independent public accountants. During this reporting period, we issued reports for the following Annual Financial Statements for FY 1998:

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 25 |

Significant Audit Products

Each of these audits was performed in support of the FY 1998 Consolidated

Department of Justice audit, which was issued in the prior semiannual period and resulted

in a disclaimer of opinion on the consolidated financial statements. A comparison of the

audit results for FY 1998 and FY 1997 follows.

| Comparison of FY 1998 and FY 1997 Audit Results | ||||

| Reporting Entity |

FY 1998 | FY 1997 | ||

| Balance Sheet | Other Financial Statements | Balance Sheet | Other Financial Statements | |

| Consolidated Department of Justice | D | D | D | D |

| Assets Forfeiture Fund and Seized Asset Deposit Fund | D | D | D | D |

| Drug Enforcement Administration | U | D | D | D |

| Federal Bureau of Investigation | U | U | Q | Q |

| Federal Prison System | Q | Q | Q | Q |

| Immigration and Naturalization Service | D | D | D | D |

| Offices, Boards, and Divisions | D | D | D | D |

| Office of Justice Programs | U | D | D | D |

| U.S. Marshals Service | D | D | D | D |

| Working Capital Fund | U | U | U | U |

| D - Disclaimer of Opinion Q - Qualified Opinion U - Unqualified Opinion |

||||

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 26 |

Significant Audit Products

Non-Tax Delinquent Debt in the Department

PCIE requested that federal IGs assess how effectively their agencies collect non-tax delinquent debt amounts and verify the reliability of accounts receivable balances. As of September 30, 1997, the Department reported $29 million of non-tax debt delinquent over 180 days. This audit was conducted to verify the amount of non-tax delinquent debt that existed and the collectibility of this debt. In addition, the audit assessed the Department's debt management activities to ensure that it takes suitable measures to collect the delinquent debt before referring it to the U.S. Department of the Treasury (Treasury) for collection.

We selected three of the ten components within the Department that managed accounts receivables. These three components¾INS, BOP, and the FBI¾represented 81 percent of Department receivables. Based on our audit, we found that:

We recommended that BOP implement review procedures to ensure accurate reporting of receivables due from the public and that INS implement formal procedures to reconcile the debt referrals, based on the DCOS database, between the DMC and the OGC. Both components agreed with our recommendations.

DEA's Hazardous Waste Cleanup and Disposal

DEA is allocated Assets Forfeiture Fund (AFF) monies annually for the removal and disposal of contaminated clandestine drug laboratory (clan lab) materials (considered hazardous waste) seized for forfeiture. Throughout the year, DEA requests reimbursement from AFF up to the allocated amount for cleanup costs it has incurred. Our audit, requested by JMD's Asset Forfeiture Management Staff (AFMS), assessed DEA's reimbursement requests and tested to determine if DEA was the seizing entity and actively involved in the case leading to the cleanup. We also reviewed certain contract management and fiscal controls, as well as costs associated with specific, possibly questionable, cleanups identified by AFMS.

We found that almost all of the costs comprising the reimbursement requests we reviewed were, as required, for hazardous waste cleanup and disposal. However, DEA requested reimbursement of at least $1.2 million from AFF in FYs 1997 and 1998 for the cleanup and disposal of hazardous waste assets for which proof of seizure and forfeiture was lacking. Further, we found that DEA field offices were not entering seizure data into the Consolidated Asset Tracking System as required, which prevents DEA's Asset Forfeiture Section from processing the forfeitures. About one-third of the cleanups we reviewed lacked clear evidence of DEA involvement

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 27 |

Significant Audit Products

or other federal seizure activity. During the period covered by our audit, there was

little DEA verification of contractors' labor and waste quantity claims. However, we did

find that the fiscal management controls we reviewed were essentially sound. DEA agreed

with the audit recommendations and is taking actions to correct the deficiencies noted.

SafeFutures

SafeFutures: Partnerships to Reduce Youth Violence and Delinquency (SafeFutures) is a 5-year demonstration grant program to help six communities reduce juvenile delinquency by implementing a range of prevention and intervention programs. SafeFutures consists of nine specific program components with numerous statutory and fiscal program restrictions. SafeFutures' overall intent is to change the way grantee communities deal with at-risk and delinquent youth. OJP's OJJDP administers the program. Each grantee will receive up to $1.4 million per year, for a total of about $7 million, to implement the program components and reform its existing service delivery system. Total program costs will be about $42 million. We audited the program to determine if (1) the design of SafeFutures is sound and generally conducive to success; (2) grants were properly solicited, selected, and awarded; and (3) the program is being adequately managed by OJP and OJJDP.

We found that the solicitation, selection, and award processes for SafeFutures grants were generally in compliance with established requirements and procedures, and the selection of the grantees was fair but that monitoring controls were weak and some official grant files were incomplete. Although OJJDP tried to be flexible where possible, it should consider obtaining enabling legislation or funding that will allow it to design future comprehensive programs with more programmatic and fiscal flexibility. We recommended strengthening management controls, clarifying program responsibility, and ensuring compliance with requirements. OJP concurred with our recommendations and implemented a variety of corrective actions.

INS and EOIR Affirmative Asylum Program

INS asylum officers and Executive Office for Immigration Review (EOIR) immigration judges administer the nation's asylum program. The asylum program allows aliens legally or illegally in this country to apply to INS for asylum. To be granted asylum, aliens must demonstrate a well-founded fear of persecution in their home country because of race, religion, nationality, political opinion, or membership in a social group. In 1994, the Department implemented major reforms to address the increasing backlog of asylum cases and public concerns over abuse of the asylum program. These reforms included new asylum regulations that became effective in 1995.

We found that the 1995 asylum reforms resulted in more timely case completions and

significantly reduced the backlog of asylum cases. However, while the new regulations

streamlined procedures and promoted efficiency, they did little to build in necessary

protections and mechanisms to maintain quality control. Also, INS did not ensure the

asylum applicants' identities were firmly established through fingerprinting and FBI

record checks. Further, we found that INS was not successful in deporting applicants

denied asylum. According to INS records, of the

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 28 |

Significant Audit Products

approximately 69,600 denied asylum seekers who were issued deportation orders from

FYs 1993 to 1996, only 6,500 were actually deported. We recommended that INS

strengthen the supervisory review of asylum officers' written case assessments, improve

data gathering for denied asylum applicants, and establish a tracking system to ensure

that rejected or unclassifiable fingerprint charts are resubmitted to the FBI for complete

record checks before granting asylum.

Trustee Audits

Audit conducts performance audits of panel trustees under a reimbursable agreement with EOUST. Private trustees are selected and supervised by U.S. Trustees and serve on panels. The panel trustees are appointed to collect, liquidate, and distribute personal and business cases under Chapter 7 of Title 11 of the Bankruptcy Code. As a representative of the bankruptcy estate, the panel trustee serves as a fiduciary, protecting the interests of all estate beneficiaries, including both creditors and debtors. Financial and compliance audits are performed of Chapter 12 family farmer trustees to evaluate the adequacy of the trustees' accounting systems and related internal controls and compliance with major statutes.

In addition to the statutory requirement to file a final account of the administration of the estate with the court, the panel trustee must provide to the U.S. Trustee an interim report at least every six months for bankruptcy cases with assets. Our audits include determinations of whether the interim reports are complete and accurate and the panel trustee has maintained sufficient management controls over estate assets. Additionally, we review the panel trustees' banking and accounting practices and test accounting transactions. During this reporting period, we issued 140 reports detailing the results of our performance audits of panel trustees and 1 report on a Chapter 12 bankruptcy case.

Our reports are issued to EOUST and include findings such as the failure of the panel trustees to deposit money in a timely manner, invest estate funds properly, and document support for all sales and disbursements. Although the frequency of such occurrences is declining, our reports continue to disclose disbursements that were not properly authorized and sales that were made without obtaining a court order. We also found frequent failures by trustees to adhere to EOUST guidelines for reporting assets and related transactions.

Single Audit Act

The Single Audit Act requires recipients of federal funds to arrange for audits of their activities. Federal agencies that provide awards must review these audits to determine whether prompt and appropriate corrective action has been taken in response to audit findings.

During this reporting period, Audit reviewed and transmitted to OJP 88 reports encompassing 256 Department contracts, grants, and other agreements totaling more than $113 million. These audits report on financial activities, compliance with applicable laws, and the adequacy of recipients' management controls over federal expenditures.

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 29 |

Audit Follow-Up

OMB Circular A-50

OMB Circular A-50, Audit Follow-Up, requires audit reports to be resolved

within six months of the audit report issuance date. The status of open audit reports

is continuously monitored to track the audit resolution and closure process. As of

September 30, 1999, the OIG had closed 241 audit reports and was monitoring

the resolution process of 352 open audit reports.

Unresolved Audits

Audits Over Six Months Old Without Management Decisions or in Disagreement

As of September 30, 1999, the following audits had no management decision or were in disagreement:

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 30 |

Unresolved Audits

Audits with Revised Management Decisions

As of September 30, 1999, the following COPS audits, which COPS previously agreed with, are now considered unresolved pending resolution by the Department's mediator/fact finder as part of the ARC process.

Additionally, the OIG and the COPS Office disagree on previously resolved recommendations contained in the Lavon, Texas, and Fort Worth, Texas, Police Department audit reports. Therefore, these two reports have revised management decisions.

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 31 |

Enhanced Revenues |

||

| Audit Reports | Number of Audit Reports | Enhanced Revenues |

| No management decision made by beginning of period | 2 | $978 |

| Issued during period | 0 | $0 |

| Needing management decision during period | 2 | $978 |

| Management decision made during

period: --Number management agreed with |

2 |

$978 |

| No management decision at end of period | 0 | $0 |

Funds Recommended to be Put to Better Use |

||

| Audit Reports | Number of Audit Reports | Funds Recommended to be Put to Better Use |

| No management decision made by beginning of period | 4 | $5,98,557 |

| Issued during period | 16 | $504,342,039 |

| Needing management decision during period | 20 | $510,322,596 |

| Management decision made during

period: --Amounts management agreed to put to better use1 --Amounts management disagreed to put to better use |

8 0 |

$506,185,848 $0 |

| No management decision at end of period | 12 | $4,136,748 |

1 Includes instances where management has taken action to resolve the issue and/or the matter is being closed because remedial action was taken. |

||

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 32 |

Audit Statistics

| Audits With Questioned Costs | |||

| Audit Reports | Number of Audit Reports | Total Questioned Costs (Including unsupported costs) | Unsupported Costs |

| No management decision made by beginning of period | 30 | $28,280,178 | $4,996,620 |

| Issued during period | 49 | $10,537,328 | $3,995,885 |

| Needing management decision during period | 79 | $38,817,506 | $8,992,505 |

| Management decision made during

period: --Amount of disallowed costs1 --Amount of costs not disallowed |

33 12 |

$26,516,593 $98,752 |

$3,593,778 $0 |

| No management decision at end of period | 46 | $12,202,161 | $5,398,727 |

| 1

Includes instances where management has taken action to resolve the issue and/or the

matter is being closed because remedial action was taken. 2 The audit report was not resolved during this reporting period because management has agreed with some, but not all, of the questioned costs in the audit. |

|||

USDOJ/OIG - Semiannual Report to Congress, April 1, 1999 - September 30, 1999 |

Page 33 |

Audit Statistics

| Audits Involving Recommendations for Management Improvements | ||

| Audit Reports | Number of Audit Reports | Total Number of Management Improvements Recommended |

| No management decision made by beginning of period | 50 | 160 |

| Issued during period | 124 | 401 |

| Needing management decision during period | 174 | 561 |

| Management decision made during

period: --Number management agreed to implement1 --Number management disagreed to implement |

1092 0 |

416 0 |

| No management decision at end of period | 68 | 145 |

| 1 Includes instances where management

has taken action to resolve the issue and/or the matter is being closed because remedial

action was taken. 2 This includes three audit reports that were not resolved during this reporting period. However, management has agreed to implement a number of, but not all, recommended management improvements in these audits. |

||