The mission of the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) is to conduct criminal investigations, oversee the firearms and explosives industries, and enforce federal laws and regulations related to alcohol, tobacco, firearms, explosives, and arson. ATF’s mission also includes working in cooperation with federal, state, and local law enforcement agencies. ATF views its role in enforcing firearms and explosives laws as significant in the battle against terrorism and supports a strategic goal of the Department of Justice (DOJ) to “enforce federal laws and represent the rights and interests of the American people.”

ATF’s law enforcement functions were transferred on January 24, 2003, from the Department of the Treasury (Treasury) to DOJ under the Homeland Security Act of 2002. ATF’s tax and trade functions remained with Treasury. ATF headquarters is located in Washington, D.C., and there are 23 ATF field divisions comprised of multiple field offices.

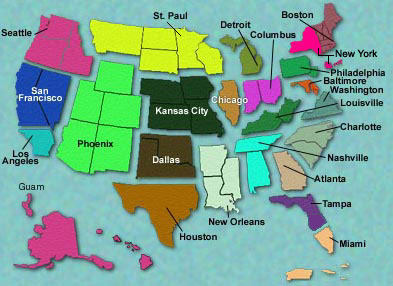

ATF FIELD DIVISION OFFICE LOCATIONS

| Source: Bureau of Alcohol, Tobacco, Firearms and Explosives |

In the course of its criminal investigations, ATF seizes items for forfeiture and evidentiary purposes. Seized items are stored in ATF vaults and explosive storage bunkers.8 Items seized may include alcohol, tobacco, firearms, explosives, ammunition, vehicles, real property, currency, and computer equipment. Those items seized for forfeiture are recorded, monitored, and managed by ATF’s Asset Forfeiture and Seized Property Branch through its Forfeited and Seized Assets Tracking System (FASTRAK), a system unique to ATF. ATF disposes of forfeited assets after judicial action is completed. Forfeited assets are disposed of using one of three actions: destruction, sale, or placement into official use. Only certain items are deemed suitable for official use: firearms, vehicles, or investigative equipment.9

As part of ATF’s transfer, DOJ and Treasury signed a memorandum of understanding (MOU) regarding ATF’s management and disposition of assets seized for forfeiture. In accordance with the MOU, assets seized on or before January 23, 2003, remained the property and responsibility of Treasury. Assets seized on or after January 24, 2003, became the property and responsibility of DOJ.

The MOU stipulated that all assets seized for forfeiture by ATF on or after January 24, 2003, would continue to be transferred to and disposed of by Treasury’s national property contractor until an asset transition plan between Treasury and DOJ could be implemented. All net proceeds from those dispositions were to be transferred to the DOJ Asset Forfeiture Fund.10 Both agencies agreed to provide a timely response to any request for information pertaining to assets covered by the MOU.

The United States Marshals Service (USMS) administers the DOJ asset forfeiture program, which includes federal partners both within and outside DOJ.11 The United States Marshals Service has not assumed management of any of ATF’s assets seized for forfeiture, however, because ATF uses FASTRAK to track its seized assets and the USMS and the other asset forfeiture partners use the Consolidated Asset Tracking System ( CATS).

The Office of the Inspector General (OIG) conducted this audit to examine ATF’s management of assets seized during investigations of suspected criminal activity. Our objectives were to: (1) determine the status of ATF’s transition to DOJ’s system for managing seized assets; and (2) assess the adequacy of ATF’s accounting for, storing, safeguarding, and disposing of seized assets and evidence in its possession.

Under the forfeiture statutes, property is formally forfeited only after the government has completed a legal proceeding intended to give any potential claimant due notice and an opportunity to contest the forfeiture. Such forfeiture proceedings fall into the following categories:

Administrative forfeiture is an action that permits the federal seizing agency to forfeit property without judicial involvement. The authority for a seizing agency to start an administrative forfeiture action is found in the Tariff Act of 1930, 19 U.S.C. § 1607. Property that can be administratively forfeited is merchandise, the importation of which is prohibited; a conveyance used to import, transport, or store a controlled substance such as vehicles, vessels, airplanes, or conex boxes; monetary instruments such as coins, currency, travelers’ checks, bearer instruments, or bearer securities regardless of value; or other property that does not exceed $500,000 in value.12

Criminal judicial forfeiture is an action included as part of a criminal prosecution. In a criminal judicial forfeiture, the defendant is charged with an offense for which forfeiture is authorized, and an additional count or forfeiture allegation describing the property and its relationship to the criminal offense is included in the indictment. Upon conviction for the underlying offense, the court may order the involved property forfeited to the government.

Civil judicial forfeiture is an action in a U.S. District Court against a specific piece of property (no person is named as a defendant). Civil judicial forfeitures are pursued independent of any criminal prosecution of the offense that justified the seizure. A judicial forfeiture (either criminal or civil) is always utilized when the value of the personal property involved is in excess of $500,000 (with the exception of cash), when the property is real estate, when ATF lacks administrative forfeiture authority, or a claim has been filed as a result of an administrative forfeiture.

In fiscal year (FY) 2005, ATF seized 199,284 property items at an estimated value of $24,307,331. As of June 30, 2006, an additional 22,030 items were seized at an estimated value of $17,345,448. Valued properties are items that can be legally sold in the United States such as vehicles, vessels, real property, jewelry, and alcohol. Non-valued properties are items that either do not have a legal market in the United States or a saleable value to the federal government such as firearms, silencers, ammunition, explosives, and tobacco.13 These non-valued items are disposed of using ATF-approved methods. In general, both valued and non-valued items are assigned an estimated fair market value in accordance with Federal Accounting Standards, the Government Accountability Office, and Office of Management and Budget guidelines. The values assigned are for accounting recognition purposes only and are not necessarily the amount realized upon final disposal. Although all items seized are assigned a fair market value, the majority of the items are deemed non-valued property.

Examples of items seized by ATF are:

Firearms — handguns, rifles, shotguns, machine-guns, sawed-off rifles or shotguns, machine-gun conversion kits, or assault weapons

Silencers — devices placed on firearms that are used to suppress the noise from discharges

Ammunition — cartridges, or cartridge cases, and cartridge components that can be used in any firearm

Explosives — blasting caps, detonation cords, bomb debris, and destruction devices

Vehicles — automobiles, motorcycles, aircraft, and vessels

Arson materials — arson debris, incendiary devices, and any other material related to the arson under investigation

Alcohol — legally and illegally acquired liquor, mash, stills, and other related equipment

Tobacco — cigarettes (contraband, stolen, or no tax paid)

Other — currency or other monetary instruments, jewelry, drugs, financial records, documents, computer equipment, general merchandise, real property, and electronic intercepts.

As detailed in the following table, the quantity and value of items seized varies widely from year to year.

ATF SEIZED ITEMS AND THEIR ESTIMATED VALUES

| FY 2004 | FY 2005 | FY 2006

(1st, 2nd, and 3rd Qtrs) |

||||

|---|---|---|---|---|---|---|

| Seized Items |

Quantity of Items |

Value | Quantity of Items |

Value | Quantity of Items |

Value |

Firearms |

12,783 |

$3,825,809 |

27,656 |

$9,770,314 |

14,576 |

$5,255,157 |

Ammunition |

5,312 |

166,833 |

12,456 |

487,962 |

5,976 |

155,447 |

Explosives |

530 |

118,029 |

1,964 |

1,214,217 |

629 |

74,363 |

Vehicles |

43 |

624,134 |

89 |

122,657 |

103 |

213,779 |

Vessels |

1 |

5,000 |

0 |

0 |

0 |

0 |

Alcohol |

26 |

2,283 |

14 |

3,444 |

46 |

155 |

Tobacco |

572 |

2,370,324 |

156,767 |

3,588,767 |

376 |

593,364 |

Other1 |

221 |

8,745,181 |

338 |

9,119,970 |

324 |

11,053,183 |

Totals |

19,488 |

$15,857,593 |

199,284 |

$24,307,331 |

22,030 |

$17,345,448 |

| Source: Bureau of Alcohol, Tobacco, Firearms and Explosives

1 Includes currency or other monetary instruments, real property, and general merchandise. |

Since forfeited assets are not necessarily disposed of in the same fiscal year or at the value they were originally assigned when they were seized, the amounts shown in the previous table and the one below will not reconcile. The table below lists both assets seized and forfeited by ATF and their associated disposal values.

NET PROCEEDS FROM ASSETS SOLD

| FY 2004 | FY 2005 | FY 2006

(1st, 2nd, and 3rd Qtrs) |

||||

|---|---|---|---|---|---|---|

| Forfeited Assets |

Quantity of Items |

Value | Quantity of Items |

Value | Quantity of Items |

Value |

Firearms |

761 |

$0 |

7,591 |

$0 |

6,642 |

$0 |

Ammunition |

4,059 |

0 |

4,229 |

0 |

3,425 |

0 |

Explosives |

9,492 |

0 |

502 |

0 |

325 |

0 |

Vehicles |

19 |

135,895 |

27 |

270,280 |

33 |

306,145 |

Vessels |

0 |

0 |

0 |

0 |

0 |

0 |

Alcohol |

2 |

6,400 |

33 |

0 |

8 |

0 |

Tobacco |

20 |

197,146 |

33 |

0 |

232 |

134,909 |

Other1 |

67 |

4,296,545 |

161 |

2,515,647 |

108 |

1,940,064 |

Actual and |

|

(2,656,199) |

|

(1,745,080) |

|

(914,529) |

Totals |

14,420 |

$1,979,787 |

12,576 |

1,040,847 |

10,773 |

$1,466,589 |

| Source: Bureau of Alcohol, Tobacco, Firearms and Explosives

1 Includes monetary instruments, real property, and general merchandise. 2 Primarily for storage and disposal costs. |

In 1990, the DOJ Deputy Attorney General approved the implementation of three specific recommendations related to DOJ’s need for the most cost-effective and accurate means to manage and improve the DOJ asset forfeiture program. The three recommendations were:

The Executive Office for Asset Forfeiture was directed to use the Asset Forfeiture Fund for the design and development of a single, integrated asset forfeiture information system for DOJ.14

All DOJ organizations participating in the asset forfeiture program were directed to revise their automation planning, development, and installation efforts to incorporate the integrated DOJ-wide system as the primary source of operational support and management information for the asset forfeiture program.

All DOJ organizations were directed to develop plans for orderly transition to the new integrated asset forfeiture system from any automated system that competed with the new system in scope, function, or purpose. The transition plan was to be submitted for approval to the Office of the Deputy Attorney General. Any investment to enhance the existing systems, regardless of the source of funding, was to be consistent with the transition plan and submitted for approval to the Office of the Deputy Attorney General.

Analysis of Seized Property Asset Management Systems

As noted earlier, DOJ asset forfeiture participants use CATS and ATF uses FASTRAK to track the life cycle of property seized for forfeiture. Data maintained within both systems identify specific pieces of property and provide details about the items, such as the seizing office; seizing agent; case number; the type, description, and value of the property; and any other facts necessary to ensure proper monitoring and disposition of the property.

When ATF transferred to DOJ in January 2003, the Asset Forfeiture Management Staff (AFMS) and ATF’s Asset Forfeiture and Seized Property Branch reached a verbal agreement to suspend the planned migration of ATF’s seized asset data into the Department’s CATS because the AFMS was upgrading its system. The upgrade changed the CATS system from dedicated terminals in user offices to a browser-based system allowing authorized users to access the system using non-dedicated computers on the Intranet. AFMS officials were concerned that injecting ATF’s system requirements into CATS would delay the upgrade schedule, adversely affecting asset forfeiture participants. The suspension was intended to allow the AFMS time to complete the upgrade of CATS prior to migrating ATF data and its system requirements.

After ATF transferred to DOJ, the AFMS contracted with a non-profit corporation for an analysis of the functional differences between CATS and FASTRAK. In June 2003, the results of the analysis were reported in the CATS-FASTRAK Gap Analysis, and included the following:

CATS and FASTRAK function on different operating systems, use different software applications, and have different network environments.

There are significant differences in the two systems for data elements, data definitions, and the structure of data tables.

FASTRAK can create detailed reports for firearms and ammunition that CATS cannot produce.

The AFMS contractor also provided an evaluation of alternative asset tracking approaches that would support the management of ATF’s seized and forfeited assets within DOJ. A second report issued in July 2003, entitled CATS-FASTRAK Alternatives Analysis and Recommendations, presented five alternatives for ATF’s use of CATS.

Alternative 1 — ATF would continue to use FASTRAK and would continue to realize the benefits of the full complement of FASTRAK capabilities. DOJ would not have a common database of seized and forfeited assets and the tracking process would likely be cumbersome and inefficient.

Alternative 2 — ATF would be required to use CATS and a common database would exist for all DOJ-seized and forfeited assets.

Alternative 3 — FASTRAK would be integrated with CATS and all of the current FASTRAK functions and capabilities would be supported by CATS. Incorporating this functionality would require a significant software development effort.

Alternative 4 — FASTRAK would have an electronic interface with CATS, and ATF would continue to realize the benefits of the full complement of FASTRAK capabilities. CATS and FASTRAK also would share a common database accessible to all DOJ asset forfeiture participants. The development of an electronic interface between CATS and FASTRAK would likely be a costly endeavor, given the significant differences in the database design of the two systems.

Alternative 5 — FASTRAK and CATS would migrate to the browser-based CATS, fully integrating FASTRAK functions and capabilities. FASTRAK and CATS would exist as parallel systems for a period of time, requiring maintenance of both systems.

The report recommended Alternative 5 for managing DOJ seized and forfeited asset tracking processes.

AFMS utilized an existing ATF support contractor to assess 658 individual ATF system requirements. A third report issued in June 2005, ATF-FASTRAK – Version 7.0.9/DOJ BBC Gap Analysis Summary 3.0, identified 99 ATF data requirements that CATS could not satisfy. ATF requires more detailed information for its forfeiture case management system than CATS provides. Some of the unsatisfied requirements are related to cases, seizures, assets, firearms, forfeitures, disposition of items, and legal counsel information. Examples are the ability to enter and maintain an Agent ID and the ability to enter and maintain the item seizure number. As of June 14, 2006, 38 of the original 99 requirements remained unresolved. The remaining 38 requirements are expected to be resolved by October 2006.

In June 2002, the Department of the Treasury, Office of the Inspector General, conducted an audit of ATF’s controls over selected property items that if lost or stolen, might compromise national security, the public’s safety, or ongoing investigations. The report, entitled Protecting the Public: Bureau of Alcohol, Tobacco and Firearms’ Control Over Sensitive Property is Adequate, made three recommendations related to the area of seized and forfeited property. The report recommended: (1) adequate physical security measures be in place at all facilities – both ATF and contractor controlled – that store seized and forfeited property; (2) all seized and forfeited property storage vaults maintain entry logs; and (3) all seized and forfeited property be entered into the tracking system in a timely manner.

A bunker is a fortified chamber mostly below ground that is often built of reinforced concrete.

Investigative equipment includes items such as portable photographic and optical equipment, sound recording or amplification equipment, radios, and televisions.

The DOJ Asset Forfeiture Fund serves as a repository for funds seized by participating agencies and the sale proceeds from forfeited property. According to Attorney General Directive 90-5, the DOJ Asset Forfeiture Program has three primary goals: (1) to punish and deter criminal activity by depriving criminals of property used or acquired through illegal activities; (2) to enhance cooperation among foreign, federal, state, and local law enforcement agencies through the equitable sharing of assets recovered through the program; and (3) to produce revenues to enhance forfeitures and strengthen law enforcement. The proceeds deposited in the Asset Forfeiture Fund are used to fund allowable costs of the DOJ Asset Forfeiture Program.

Asset forfeiture participants in DOJ include the Drug Enforcement Administration, Federal Bureau of Investigation, United States Marshals Service, United States Attorneys’ Offices, the Asset Forfeiture and Money Laundering Section of the Criminal Division, and the Justice Management Division’s Asset Forfeiture Management Staff. Non-DOJ participants include the U.S. Department of Agriculture; the U.S. Postal Inspection Service which is the law enforcement unit of the U.S. Postal Service; the U.S. Food and Drug Administration, which is part of the U.S. Department of Health and Human Services; and the Bureau of Diplomatic Security, which is part of the U.S. Department of State.

Bearer instrument – a document that indicates the bearer has title to property, such as shares or bonds. Bearer security – possession of the security confers ownership as there is no register of ownership.

Title 26 U.S.C. Chapter 53 § 5872 states that any firearm involved in a violation of the chapter shall not be sold at public sale.

The Department reassigned the policy functions of the Executive Office for Asset Forfeiture to the Criminal Division in 1994. At the same time, the financial and administrative functions were transferred to the Justice Management Division.